How Gated Offers Increase Financial Services Customer Acquisition

If you’re a marketer in the financial services industry and you feel like a hamster racing on a wheel, you’re not alone. Our customer acquisition report revealed that 78% of financial services marketers are under greater pressure to meet their acquisition and revenue goals than last year.

Don’t worry—help is on the way. You can increase customer acquisition and loyalty by leveraging a new promotion that’s been highly successful in retail, travel, and other industries: gated offers.

What Are Gated Offers?

Gated offers are specialized products, services, or offerings that are targeted to high-value customer segments based on a customer’s life stage, occupation, or affiliation. They include groups like students, teachers, seniors, and the military. Because gated offers are exclusive to a group and rooted in a buyer’s identity, they tap into people’s deep sense of belonging to a tribe, which:

- Creates deeper brand connections.

- Helps drive long-term customer loyalty.

- Results in greater impact than other customer acquisition tools.

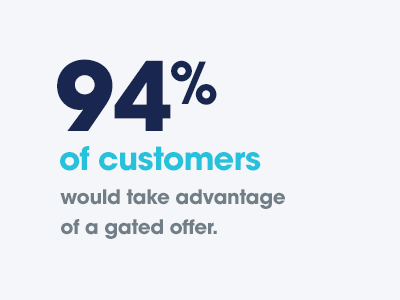

Our consumer survey showed that 94% of customers would take advantage of a gated offer. And when companies provide gated offers, 82% of customers are more likely to shop with that brand, and nearly half are more likely to purchase sooner.

5 Steps to Creating a Successful Gated Offer

01 Create the Offer

Perhaps it’s a special introductory rate credit card for students or a unique financial product you’d like to offer to members of the military.

02 Collect Privacy-Friendly Information

Customers opt-in by providing only basic personal details such as their name and email.

03 Confirm Eligibility

SheerID’s Verification Platform taps into 200,000 authoritative data sources to instantly verify buyers’ eligibility.

04 Reward Your Customers

Applicants enjoy their exclusive offering.

05 Reap the Long-Term Benefits

Use the customer data you collected to nurture long-term relationships and to send timely information for cross-sell and upsell offers.

Gated Offers for Students

College students are a large and lucrative group to target with gated offers. In the US alone, college students have $574 billion in spending power. And SheerID’s student verification can reach 230M college students in 108 countries in their languages.

Expanding Your Customer Base

When you already have good customers who are parents of college students, gated offers enable you to gain a greater share of the family’s business by extending special opportunities to their kids. This deepens your relationship with the parents and starts a relationship with their college-aged children.

Customer Loyalty Begins with Students

Acquiring college students now pays dividends by resulting in long-term customer loyalty when they graduate and enter the workforce. Research shows that college students have a 10-year customer lifecycle. If you can capture them at a time when their brand affiliations are still forming, you can extend that loyalty well into their future.

Gated offers are an ideal way to launch those long-term relationships. Ninety-one percent of students say they would be more likely to shop with a brand that provides them with a gated offer. And 83% of shoppers 18-34 years old would let their friends and family know about a great gated offer opportunity.

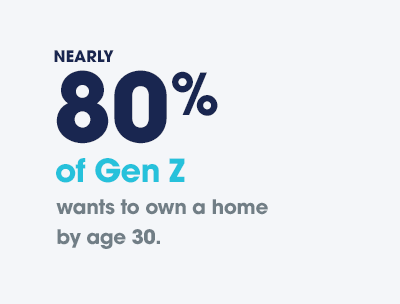

Gen Zers are a particularly worthy group to target because they’re highly pragmatic and financially savvy. Nearly 80% of Gen Z wants to own a home by age 30. They know that a great credit rating is their ticket to a sound financial future. Engaging them with a credit card now makes you top of mind when they’re ready for a home loan.

Mitigating the Risk of Acquiring Student Customers

Gated offers are one of the safest ways for financial companies to reach students because many students—especially international ones—have a thin file or no file at all. Gated offers help you mitigate your risk by definitively confirming their university enrollment.

Gated Offers for the Military

The military community is another major market opportunity. They are also a large and lucrative group with 37 million members and $1 trillion in spending power.

Financial services companies have a unique opportunity to provide military members and their families with gated offers on products like special credit cards and better rates on loans and insurance programs. And as 250,000 active duty military transition to civilian status each year, you can continue to deepen your relationship as they move to purchase homes, cars, and other big-ticket items of civilian life.

Extending a gated offer to military spouses furthers your reach. Ninety-three percent are women, and they are in charge of more than 85% of their families’ consumer purchases.

Honoring the Military Creates Broad Customer Loyalty

For members of the military and their families, military service is not just a job, it’s a matter of honor. They identify strongly with their tribe, and feel that deep sense of community long after they leave active duty. That translates into customer loyalty for companies who recognize their commitment with gated offers.

Gated offers also increase goodwill among everyone who supports the military community. The T-Mobile ONE Military program is a great example of how a brand is using gated offers as one part of a broad brand awareness campaign.

Military program is a great example of how a brand is using gated offers as one part of a broad brand awareness campaign.

The numbers underscore how gated offers spur military customer loyalty:

- 95% of the military are more likely to shop at a company that offers a military discount.

- More than 90% of military families focus their shopping decisions around businesses who offer some type of military discount.

- 76% of the military community learn about discounts from word of mouth.

Using Gated Military Offers to Mitigate Risk

Digital verification provides an additional data point for assessing risk when an individual is applying for credit. For example, you could create a gated offer that provided interest-free credit to members of the military, then use SheerID to verify their status to confirm eligibility.

The Benefits of Digital Verification

Prevent Fraud

Financial services companies are keenly aware of risk, and identify fraud is widespread. This makes digital verification even more important when providing special offers targeted to any group.

SheerID’s Digital Verification Platform uses 8,900 authoritative sources to instantly verify a customer’s eligibility for a gated offer. Document review is available, when necessary, to ensure 100% coverage. Digital verification also gives you first-party data—a highly valuable commodity.

Digital verification also enables you to re-verify customers to ensure their ongoing eligibility and to upsell them to other products when the time is right. For example, when students graduate, you can promote loan options for them to purchase their first car or refinance their student debt.

Increase Internal Efficiency

Manual verification can be difficult and time-consuming, and it puts all the risk on your employees. Digital verification replaces manual verification, which streamlines operations and saves you time and resources.

SheerID’s digital verification provides flexible implementation options, including hosted, API, or a hybrid. The platform is self-service, making it simple to launch a program.

Improve Customer Experience

The number one priority for financial services organizations today is getting the customer experience right.

SheerID supports this effort by providing end users with a frictionless experience that integrates seamlessly into your application processes. The process occurs entirely within your brand and requires only the information consumers have said they are most willing to provide.

And gated offers verified by SheerID are 100% consent-based, so your programs are GDPR and CCPA compliant.

Optimize Your Campaigns

SheerID’s tools boost conversions by enabling you to re-engage customers who don’t complete the verification process. Email and SMS capabilities make it easier to grab users’ attention. This is particularly good for students, who vastly prefer text over email.

Use the Performance Dashboard to Track Programs

SheerID’s Performance Dashboard provides granularity and data visualization for bottom-line metrics like conversion rate, number of loans originated, average loan size, and the amount of fraud prevented. Customizable reports make it easy to keep executives and other stakeholders informed.

Customize Your Programs Further

SheerID empowers flexibility in who you target. For example, you can engage all college students or target a subset, such as graduate students or students of a particular university.

Likewise, you can apply different levels of granularity to your gated military offers, focusing on active-duty, veterans, or spouses and dependents.

Leading Brands Are Using Gated Offers to Increase Customer Acquisition

Brands across a wide range of industries are benefiting from gated offers and reporting significant successes in customer acquisition and loyalty.

YouTube, SoundCloud, Spotify, Headspace, and Comcast are all using gated student offers to reduce churn and increase customer acquisition and loyalty for their subscription-based services. Students convert to full price when they graduate at rates as high has 98%.

American Giant’s gated military offer has been a great success for the startup clothing company. The company’s military email promotions are their best-performing, and by replacing manual verification with digital verification, their staff saved up to ten hours each week.

Globus launched a gated military offer on their tours. This new customer acquisition program outperformed the company’s other flash sales by 20% and required 75% less effort to implement.

Kettlebell Kitchen created a gated offer for military and first responders—customer groups likely to be into the brand’s fitness-oriented meal delivery service. The program triggered a 6x increase in orders, with 83% more new military and first responder customers signing up every week.

Customer acquisition costs (CAC) have increased 60% in the last five years. Gated offers give financial service companies a highly cost-effective way to acquire new customers in profitable segments. Gated offers deliver 3x conversion and ROAS as high as 20:1.

Learn More about How Gated Offers Can Work for You

Download The Definitive Guide to Gated Offers or Contact Us.